Rodney McMullen's compensation as Kroger's CEO has sparked considerable debate. His total compensation package, exceeding $20 million in 2020, reflects Kroger's strong financial performance. However, the significant disparity between his earnings and those of the average Kroger employee raises critical questions about fairness and ethical business practices. This article analyzes McMullen's compensation, explores the factors driving it, and examines the broader implications of this substantial pay gap.

The CEO's Compensation and Employee Earnings: A Stark Contrast

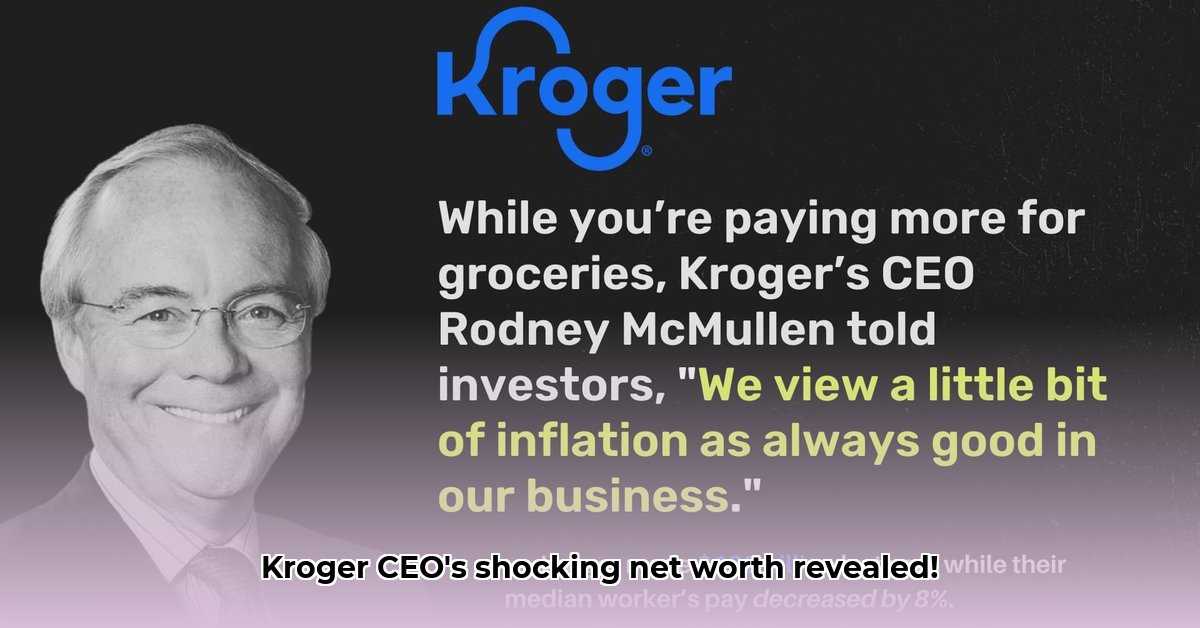

McMullen's substantial compensation contrasts sharply with the average Kroger employee's earnings. In 2021, the CEO earned 5348 times more than the average worker; while this ratio improved to 502:1 in 2023, the significant gap persists. This raises concerns about fairness and ethical business practices. Is such a vast differential justified, even with strong company performance? This is a complex question with no easy answer. While proponents argue high CEO pay attracts and retains top talent, critics contend these astronomical salaries exacerbate income inequality. Research suggests a correlation between excessive CEO pay and decreased employee morale and productivity, highlighting the need for a balanced approach.

Performance Bonuses: Incentives and Accountability

A significant portion of McMullen's compensation derives from performance-based bonuses. This model, while seemingly fair, raises concerns about transparency and accountability. The specific metrics determining bonus amounts aren't always publicly disclosed, leading to questions about their true reflection of overall company performance. Focusing solely on shareholder returns may incentivize behaviors detrimental to employees or the long-term health of the company. A more holistic approach, incorporating employee satisfaction, environmental sustainability, and community engagement, could better align executive and overall company success.

Stakeholder Perspectives on the Pay Gap

Different stakeholder groups view McMullen's compensation and the pay gap differently:

| Stakeholder Group | Key Concerns | Desired Outcomes |

|---|---|---|

| Kroger Shareholders | Strong ROI; responsible executive pay | Transparency in executive compensation; sustainable growth; ethical business practices |

| Kroger Employees | Fair wages and benefits; equitable income distribution | Salary increases reflecting company performance; better representation of their interests |

| Government Regulators (SEC, etc.) | Compliance with regulations; preventing abuse of power | Stronger regulations and clearer guidelines on executive compensation; increased oversight |

| General Public | Corporate social responsibility; reducing income inequality | Greater corporate accountability; fair compensation policies reflecting company values |

These differing perspectives highlight the complexity of the issue. What constitutes "fair" compensation varies greatly depending on the stakeholder's perspective.

Risks Associated with the Widening Pay Gap

The significant pay gap presents several risks:

- High Likelihood, High Impact – Public Backlash: Negative media attention and public criticism could damage Kroger's reputation.

- Medium Likelihood, High Impact – Increased Regulatory Scrutiny: Government agencies may increase oversight, leading to investigations and potential fines.

- High Likelihood, Medium Impact – Employee Dissatisfaction and Turnover: Low morale and high turnover can be costly, impacting productivity and recruitment.

Kroger needs a strategy that promotes transparency, improves employee relations, and fosters fairness to mitigate these risks. This might include a revised compensation structure better aligning executive and employee pay while still incentivizing performance.

Ethical Considerations: Justifying a Large CEO-to-Employee Pay Gap

The ethical justification of a large CEO-to-employee pay gap hinges on several factors:

- Perceived fairness: The raw numbers aren't sufficient; perception of fairness is crucial.

- Transparency: Clear communication of compensation decisions is vital for maintaining morale and success.

- Demonstrable contribution: The CEO's specific contributions to the company's performance and long-term value creation must be evident.

- Alignment of incentives: CEO incentives should align with both short-term and long-term employee and shareholder value.

- Employee feedback: Open communication and channels for addressing concerns are essential.

- Regulatory compliance: Proactive strategies for managing risks and opportunities related to regulatory scrutiny are necessary.

Ethically justifying a significant pay gap requires a demonstrable link between the CEO's leadership, company performance, and a commitment to fair treatment of all stakeholders. This is achieved through careful planning, clear communication, and a focus on shared success.